Keeping Track of Your Finances and Maintaining a Work–Life Balance During Your Second Degree – A Dentist-First Perspective

Author: Alexandra (Sasha) Jigoulina

Returning to university for a second full-time degree is a challenge in itself — and one of the biggest questions for many is: how will I fund it?

This short bulletin aims to make the process a little less daunting by sharing practical advice and personal experience. Although written from a dentist-first perspective, the same principles can help anyone balancing study, work, and life during a second degree.

In this guide we’ll cover:

• Funding options available

• Organising your work schedule

• Keeping track of your finances

• Maintaining a healthy work–life balance

Funding Options Available

Tuition Fee Loan

Medical and dental degrees are among the few eligible for a second tuition fee and maintenance loan.

The options available vary depending on where you are from in the UK. The BMA has a great webpage summarizing the relevant agencies for each region: https://www.bma.org.uk/advice-and-support/studying-medicine/becoming-a-doctor/medical-student-finance

For students from England this is Student Finance England (SFE)

NHS Bursary

Available to students in England.

• Undergraduate-coded courses are eligible for a full tuition fee bursary from year 5 (up to £9,535)

• Graduate-entry courses qualify for a partial tuition fee bursary from the second year onwards (up to £3,830)

• Means and non-means tested bursaries (£1,052 for all students)

• Additional funding is available for travel to placements, disability support, and childcare costs.

Combined, the NHS bursary and tuition fee loan typically cover all tuition fees from year 2 onwards for graduate-entry courses.

University Bursaries

Many universities offer additional bursaries for medical and dental students.

For example, Warwick Medical School automatically assesses eligibility for their bursary if you’ve applied for a household income assessment through your funding body.

It’s worth checking what your own university provides — these schemes can make a real difference.

Fee Exemptions While a Student

• BAOMS membership and conference fees

• MFDS RCS Ed membership fees

Organising Your Work Schedule

Students fund their degrees in different ways. The most common include:

• Locum or bank shifts in maxillofacial units

• General dental practice work

A written diary is invaluable for keeping track of both your university and work commitments and avoiding scheduling conflicts.

From experience, working around two weekends per month strikes a good balance between maintaining a predictable income and ensuring enough rest. Setting clear boundaries helps prevent burnout — it’s tempting to accept every available shift, but if you build a good relationship with your trust, work opportunities will continue to come your way.

Hospital bank work often provides more stable access to shifts than agency locuming, though agencies may suit those seeking flexibility across multiple sites.

Other important considerations:

• Indemnity: keep your cover up to date with your current hours and job role. Most providers are happy to provide multiple quotes so you can compare coverage options. E.g. a quote for working in hospital alone or hospital + general practice.

• NHS Pension: contrary to what I myself was previously told, bank workers can usually continue contributing to the NHS pension scheme. All the trusts I’ve worked with have supported this.

Keeping Track of Your Finances

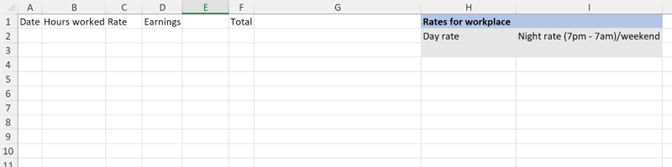

If you work across several trusts or practices, payments may arrive at different times — making it easy to lose track. I use a simple Excel spreadsheet to stay organised, and you may find this helpful too.

On the main sheet, record both your predicted and actual pre-tax income for each month. Highlight pending payments in yellow and overdue ones in red to easily identify discrepancies. The number ‘10’ has been placed in boxes simply to highlight the main sheet is set up to automatically total your earnings.

Sub-sheets for each workplace can include details such as dates, hours, rates, and predicted earnings. This helps you calculate your monthly income and plan shifts efficiently.

Tracking your total annual income also aids in tax planning. If your earnings approach the 40% tax threshold (£50,271), consider postponing extra shifts until the next tax year.

Finally, remember to complete your tax return and claim allowable expenses such as GDC fees, indemnity, and CPD courses — these small steps can add up significantly over time.

Maintaining a Work–Life Balance

Schedule time for rest and social connection just as deliberately as you schedule work or study. It’s surprisingly easy for weeks to pass before you realise you haven’t given yourself a proper break.

My personal rules include:

• Tuesday evenings reserved for salsa classes

• Two free weekends per month

• Seeing friends or family at least once a month

Setting these boundaries has been vital in preventing burnout and maintaining focus. Everyone’s approach will differ — the key is to find a rhythm that lets you sustain your studies, finances, and wellbeing in the long term.

Final Thoughts

Everyone manages their time and finances differently, but I hope these insights help you feel more organised and confident as you navigate your second degree. With the right structure and boundaries, it’s possible to thrive — not just survive — during this exciting new chapter.